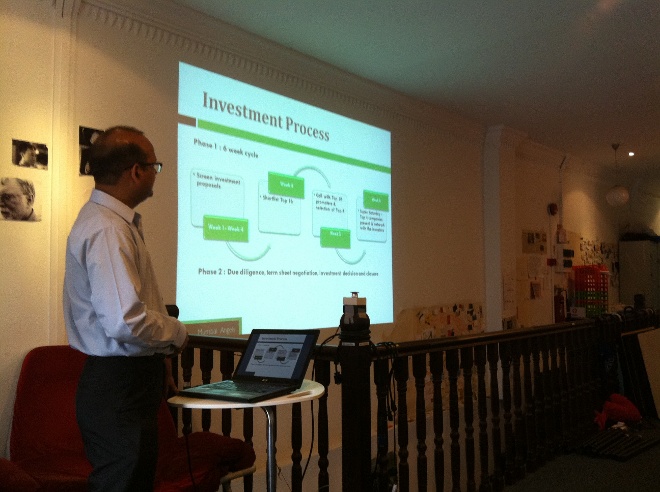

JFDI Mentor Anil Joshi, head of the operations at Mumbai Angels, a leading Angel Investment forum in India, gave founders advice on how to raise angel funding at a talk at hackerspace.sg on Saturday. Mumbai Angels brings startups face to face with successful entrepreneurs, professionals and executives who are interested in, and have funds available, to invest.

What was some of Anil’s advice to the founders?

Ideal Startup Size is 2-3 Founders

“Usually it’s easier to find investment as a team. Individuals have their own expertise and ideal functions, but to run an organization you usually need more functions. Plus, it’ s a bit rude to say but if you are running a company as a one man show and something happens…then what happens to the business? I’ve found that 2-3 founders is ideal.”

Have a Plan B for your business

“99% of the time an entrepreneur doesn’t have a plan B because so married to plan A. It’s good to have a plan B. If you realize your plan (plan A) is not working, then you can get to work on plan b. Don’t keep burning money on a plan that isn’t working.

Plan B doesn’t have to mean an entirely different product or direction – for example, plan A could be to hit the Singapore market but plan B could be to test the product in another market if you aren’t getting traction in Singapore.”

Hustle

“If you don’t do it now, there is a guy who will do it yesterday.”

Anil heads operations at MA. Anil’s professional experience includes involvement in corporate management functions in medium and large organizations, Investment in startups, Project management, Joint Ventures & business development and sits on board of 4 portfolio companies. He has worked with B.K. Birla group of companies (Textile div), Business Access India (Scandinavian Consultancy), Transasia Biomedica (leading Diagnostic co) and Artheon Group (diversified group). While at Mumbai Angels, Anil was instrumental in closing over 15 deals in Mumbai Angels Anil has bachelors degree of Engineering, PG in Management (Marketing) & PGDBM in Strategic Finance and Control.