TL;DR: In the 6 years since JFDI started, the global startup ecosystem has evolved and accelerators including JFDI must evolve with it. Meng Wong has won a fellowship at Harvard Law School to spin out a new startup called Legalese from JFDI. Back in Singapore, JFDI has completed its last bootcamp and is now exploring what a next generation ‘startup factory’ might look like in Southeast Asia, writes Hugh Mason.

TL;DR: In the 6 years since JFDI started, the global startup ecosystem has evolved and accelerators including JFDI must evolve with it. Meng Wong has won a fellowship at Harvard Law School to spin out a new startup called Legalese from JFDI. Back in Singapore, JFDI has completed its last bootcamp and is now exploring what a next generation ‘startup factory’ might look like in Southeast Asia, writes Hugh Mason.

This update appeared first in the JFDI OpenFrog Google Group.

Thank You

JFDI.Asia could not have started without huge support from the community gathered round our OpenFrog Google Group. As the first accelerator operators in Southeast Asia, Meng Wong and I have always known we were conducting a giant experiment. So, each year, we have aimed to share a ‘lab report’ about our findings with you, the people whose insights and support made it possible from our very first Request for Comments.

In December 2015, JFDI graduated its last general accelerator batch in Singapore. We are now building in new directions on what we learned nurturing thousands of entrepreneurs and investing in 70 startups. So this post brings the first phase of our experiment to an end. With it Meng and I pass the baton on to others. We hope that this summary and the discussion and posts that follow will help everyone to learn from the dead-ends we discovered as well as the things that worked out.

In December 2015, JFDI graduated its last general accelerator batch in Singapore. We are now building in new directions on what we learned nurturing thousands of entrepreneurs and investing in 70 startups. So this post brings the first phase of our experiment to an end. With it Meng and I pass the baton on to others. We hope that this summary and the discussion and posts that follow will help everyone to learn from the dead-ends we discovered as well as the things that worked out.

Meng and I discussed this post before he left for the US a couple of weeks back. I hope that he and the many people who have been a part of JFDI chip in with comments, questions and different perspectives because it’s only by reflecting on what happened openly that we can all learn. Where readers ask for it, I will commit to writing in more depth on topics raised in comments and I am sure Meng will do too, when we both have time.

First, some context. JFDI’s last batch of startups graduated five years after JFDI began full-scale operation and ten years after Y-combinator set up shop in California. The world’s startup ecosystem has evolved beyond all recognition in the last decade. Y-combinator no longer even describes itself as an accelerator, focusing instead on its role in investment. In the last year it has launched and pivoted away from its YC Fellows program to a MOOC. Southeast Asia’s startup ecosystem is also now very different, hence JFDI must change too.

Recap: Why we set up JFDI

It’s hard for anyone meeting all the noise about startups in Singapore for the first time today to imagine how different things were in 2009. Now, there is about $2bn of early stage capital available within a few hundred metres of my desk in One North and the same distance will soon sweep up perhaps 1,000 startups when new buildings nearby open their doors. Back when Meng and I met, Singapore had great financial and intellectual capital but it lacked social capital for startups. There was simply no one place where entrepreneurs, engineers and innovators came together. Go to the earliest posts on OpenFrog and you can read the discussions that led many of us to set up hackerspace.sg, Singapore’s first coworking space and geek community. We did not know where it would lead, only that getting people who actually built stuff together had to be a good foundation.

Back then words like ‘lean startup methodology’ and ‘accelerator’ were unknown on this side of the planet and even some of the financial mechanisms we now take for granted, such as convertible notes, seemed like witchcraft to most traditional investors. What is now JTC Launchpad was a collection of derelict old factory buildings and there was no MRT station at One North. But we did have some early local internet success stories like JobsCentral and tenCube. A foundation for silicon valley’s success was its pay it forward culture whereby risk capital and know-how get recirculated when founders enjoy success. So it felt really important that the first generation of our local internet entrepreneurs were seen to support the next generation. A big thank you to the JobsCentral and tenCube teams for reaching into your pockets, taking a risk and investing in JFDI along with a group of local angels.

Back then words like ‘lean startup methodology’ and ‘accelerator’ were unknown on this side of the planet and even some of the financial mechanisms we now take for granted, such as convertible notes, seemed like witchcraft to most traditional investors. What is now JTC Launchpad was a collection of derelict old factory buildings and there was no MRT station at One North. But we did have some early local internet success stories like JobsCentral and tenCube. A foundation for silicon valley’s success was its pay it forward culture whereby risk capital and know-how get recirculated when founders enjoy success. So it felt really important that the first generation of our local internet entrepreneurs were seen to support the next generation. A big thank you to the JobsCentral and tenCube teams for reaching into your pockets, taking a risk and investing in JFDI along with a group of local angels.

Joi Ito, now Director of MIT’s Media Lab, and Dave McClure (who was just starting 500 Startups) shared a lot of advice with us. Thanks also to David Cohen, co-founder at Techstars, who we met at what I think was the very first Echelon conference with about 100 people in a borrowed room. David called me on 10 January 2010 to suggest that Meng and I set up the region’s first accelerator and I think we incorporated the next day. Perhaps the most valuable advice that David and his co-founder Brad Feld gave us was that it would take 20 years to build an ecosystem. They stressed that it was the ecosystem, not the accelerator or its individual startups, that really mattered.

Joi Ito, now Director of MIT’s Media Lab, and Dave McClure (who was just starting 500 Startups) shared a lot of advice with us. Thanks also to David Cohen, co-founder at Techstars, who we met at what I think was the very first Echelon conference with about 100 people in a borrowed room. David called me on 10 January 2010 to suggest that Meng and I set up the region’s first accelerator and I think we incorporated the next day. Perhaps the most valuable advice that David and his co-founder Brad Feld gave us was that it would take 20 years to build an ecosystem. They stressed that it was the ecosystem, not the accelerator or its individual startups, that really mattered.

I believe that we became the fourth members of what was then called the Techstars Network, attending its first meetup in New York City in 2011 when there were only a handful of accelerators in the world. The Network is now called the Global Accelerator Network (GAN) and it has been fascinating to see how the GAN’s members from around the world began from relatively different starting points in different contexts but converged to a surprising degree in the processes we use. Sharing know-how, metrics and emerging insights have all been invaluable to help us manage and track our progress.

How we fared

The start of JFDI is documented in OpenFrog and later media coverage picks up on the public impact. Thank you to all the tech blogs, local and international media channels from the Wall Street Journal, New York Times and the Financial Times that have featured what we do, as well as Spring Singapore, the MDA and Singtel Innov8 who sponsored our first year. Later, IIPL became our biggest single investor alongside family offices and high net worth individuals from around the region.

These numbers give some indication of the impact we have been able to achieve with help from the whole community:

-

10 Startup Weekends delivered with many partners (including the first in Singapore, Philippines and Thailand)

-

400+ Startups and 1,500+ entrepreneurs from 40+ countries were supported through our JFDI Discover pre-accelerator program.

-

$3m raised and invested in 70 startups through our JFDI Accelerate program. Thank you to our private, family office and institutional investors. Your collective portfolio is now independently valued >$60m. For each batch of 8-12 startups that we recruited, we accepted approximately 4% of teams applying. They came in valued between $200-500k and 50% went on to secure seed funding averaging about $500k at valuations of $1.5-3.5m. The talented people whose businesses didn’t work out were often recycled into the teams that did so now there is a huge frog mafia that shares our bootcamp as its common experience. Two years after JFDI, about 15-20% of the teams that secured seed funding look like being really strong winners, with the rest dead or zombies. So overall the hit rate is about 10% of the teams we backed, very typical of an early stage portfolio.

-

We built a network of over 100 talented mentors who are now contributing to many accelerators and startup programs around the region and our Ambassadors supported startup events in Thailand, Philippines, India and Malaysia.

-

40+ startups supported through our JFDI Go Global programs from Norway, Kazakhstan, Russia and Korea and as many more through events and workshops we have run in Taiwan, Malaysia, Myanmar and Cambodia.

-

250+ Weekly Open House events held in Singapore since 2012, each attended by 20-200 visitors (depending on whether there was free beer or not). So we have probably facilitated more than 10,000 founders, mentors, investors and researchers to meet in total.

-

We have run Corporate Innovation events of different kinds with Google, Facebook, Amazon Web Services, Mediacorp, BOSCH, Boeing, Munich Re, UBS, Manulife and others. We now have a joint venture in Vietnam as a result.

-

We recently piloted an open source JFDIx accelerator in Sri Lanka.

-

We served thousands of cups of some of the finest coffee in Singapore at a time when there was no decent coffee shop in One North.

Legacy: Learning from what didn’t work

As engineers we firmly believe that failure is the truest teacher. As I get a chance I will blog about specific learning points but, looking at the big picture, there are two big challenges that we think the next generation of accelerators in Singapore still have to overcome.

Like many of our peers outside the USA, we never found a way to recirculate risk capital fast enough to make JFDI a self-sustaining business. In the US, some Techstars accelerators have been able to virtually guarantee that one startup from each of their batches will realize value within 18 months or so after the program finishes. So the accelerator’s investors get 2-3X back on their money and everyone is happy to roll the dice again. In Asia, the time to exit is more like 6-8 years and the valuation at exit is perhaps 30% of that it would be in the US. So any accelerator trying to sustain itself independently will find it very tough going in this part of the world. Corporate sponsorship is one way to load the dice favourably but it brings its own challenges and compromises. Generating revenue through activities like co-working is challenging in Singapore when public agencies provide it for free for their own good reasons.

Secondly, there are some fundamental challenges about running an accelerator in Singapore. We still believe it’s a great place to incorporate and finance a business for a really exciting region of the world. Yet high costs, a tight market for tech talent and restricted immigration mean that a different model to what we adapted from Techstars probably would be better. Good luck, for example, to the team trying to transplant Entrepreneur First’s astoundingly successful model from London to Singapore. Undoubtedly bits will work immediately and others will need some adaptation. It feels like we are definitely at ‘Peak Accelerator’ locally and there will undoubtedly be disappointment for many late entrants as they discover constraints on startup and mentor talent and the real costs of running a founder-friendly accelerator. Fundamental cultural differences and different expectations from investors mean that models from the West or China simply don’t work out of the box in Southeast Asia. Steve Blank, the father of Lean Startup, even believes that his model won’t work out of the box across the border from the US to Canada, so the challenge is to create something that works with the local context everywhere and that will also be true as Indonesia, Philippines, Thailand and Vietnam try to follow Singapore’s lead.

Legacy: Learning from what did work

Of course the startups we worked with matter a lot to us but Meng is fond of saying that the real purpose of JFDI was to innovate the process of innovation. In that sense the long term legacy of JFDI is also something we are proud about.

Locally, our startups created a great return for investors that should crystallize in the near future with some exits. The last few weeks have been gratifying asFynd, Appknox and Glints have all raised substantial funding in a market that is now a lot more difficult. There are many more deals in the offing and which have closed but we cannot discuss in public (because the startups and investors involved don’t want to disclose them). JFDI’s community helped to put Singapore on the world startup map and we are now working with Startup Genome to try to quantify that. Our alumni have created over 300 high value jobs and we have inspired scores of new mentors and investors to enter the startup scene. They are now working with the accelerators that have followed us locally. We opened our processes up to local government agencies in good faith and their staff are now running accelerators of their own.

Looking beyond Singapore, we have spoken to thousands of delegates at events around the world. The model we evolved locally has been copied many times and our former staff are now setting up startup support programs in several countries. We learned hugely from the GAN and Meng has taken part in the MIT Regional Entrepreneurship Acceleration Program so the opportunity to share and learn from others has been very fulfilling. Two of our former staff have taken their startups through Y Combinator and our former interns are now working at MIT, Imperial College and other top Universities. The founders who came through our early programs are mentoring others in Indonesia, Thailand and elsewhere and the sense that we began to seed a ‘pay it forward’ culture in Asia’s entrepreneurial community is satisfying.

More formally JFDI’s experience has been captured in several academic case studies. At a time when it was still not clear how to define an accelerator, I wrote my Master’s thesis to try and capture a lot of what GAN members had learned about the social structures and processes required. It’s a sign of the pace of development that parts of that are already now outdated. I have just finished co-editing a book that captures 8 case studies of startups in Singapore. It will launch shortly with detailed accounts of 3 JFDI alumni. Meanwhile Meng put a lot of energy into developing standardized legal paperwork which is now used by countless startups and investors to save time and money doing deals. His Map of the Money is still a key reference point for anyone seeking to raise funding locally and the library of startup failure patterns, the model of startup fits and the ‘frogscore’ concept for screening startups have all become part of our methodology that gives us confidence we can guide startups and investors through the rocky early years.

Nothing is Forever

Given all that it might seem strange that we are stopping accelerating startups in Singapore. The turning point came last year when we were both invited to the Istana, Singapore’s presidential palace. It gave us both the sense that now startups are mainstream in Singapore, our job as pioneers is done and it’s time for the frog to leap to a new frontier.

Meng has made the biggest leap, accepting a fellowship at Harvard University’s Berkman Klein Center for Internet & Society. He joins a roll of honor including John Perry Barlow, lyricist for the Grateful Dead and co-founder of the Electronic Frontier Foundation, Larry Lessig, co-founder of Creative Commons and author of Code is Law, and David Weinberger, inventor of tagging and author of Small Pieces Loosely Joined. Meng will spend the 2016–2017 academic year away from Singapore developing a new SaaS startup called Legalese.com. It is a spin-out from from JFDI inspired by a vision that “software is eating law”.

Back in Singapore our team has restructured and spent the last nine months exploring new models for startups to create new ventures in partnership with corporations. A lot of that has been under NDA so that is why we have been quieter than usual. We will shortly be able to share more about the joint venture in Vietnam that we have set up with BOSCH and others to explore a new model. I am enjoying teaching part time atNUS and with A*Star to explore how we can connect researchers with deep technology innovations to the entrepreneurs and business model innovations they also need to achieve impact.

Back in Singapore our team has restructured and spent the last nine months exploring new models for startups to create new ventures in partnership with corporations. A lot of that has been under NDA so that is why we have been quieter than usual. We will shortly be able to share more about the joint venture in Vietnam that we have set up with BOSCH and others to explore a new model. I am enjoying teaching part time atNUS and with A*Star to explore how we can connect researchers with deep technology innovations to the entrepreneurs and business model innovations they also need to achieve impact.

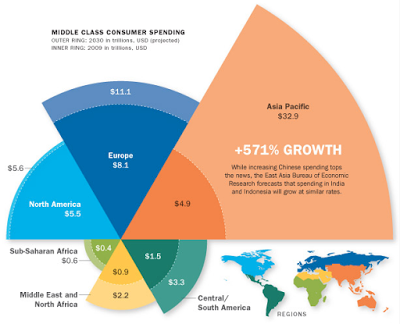

The opportunity we see is to create a structure that can span a fantastically diverse and fragmented Southeast region and scale with it. Leaving out India and China, our region has a population of perhaps 600 million, of which 10% might already be classfied as Middle Class. That’s important because they have relatively consistent lifestyles and therefore there is a good chance for regional scale startups to capture value from their spending, set to become the global growth story of the next decade. Our hunch is that it will take collaboration with corporations to make startups into scale-ups to address this opportunity, so that’s why we are focusing so much energy to explore this with our new partners. Just as when we launched the region’s first accelerator, there are no guarantees but we are giving it our best shot.

As we move into a new phase, thank you to everyone here for being part of JFDI, for creating such a lot of Joy around the Joyful Frog and good luck to all in the space we all helped to create. I’m going to give the last word to Meng because he always sums up what we try to do best: “Entrepreneurship will always be difficult … but it doesn’t have to be lonely”.

Great work Hugh, you guys are pioneers who have had amazing impact. Looking forward to hear what you are up to next.

Eythor (Thor)

Hugh, what a massive impact you’ve had thought-leading your local ecosystem and giving entrepreneurs a hope for their dreams to become a reality.

You’ve been an awesome mentor to me doing the same in NZ, where sadly, my observations align with yours too in this ecosystem.

Looking forward to both staying in touch, what you do next, and continuing to be inspired by your global leadership.

All the best,

-Dan

In a number of Singapore start-up related articles I have noted a sound bite -“high value jobs” – frequently used. What is the accelerator / start-up market accepted criteria or definition of a “high value job” for the purposes of this article & others. Thanks.

I am not an economist but in my work with government agencies around the world, they often use ‘Gross Value Added’ as a metric to evaluate interventions they make in the economy. ‘High value jobs’ generate lots of GVA, which matters because GVA is what gives businesses the ability to pay taxes, wages and dividends, and to make savings, all of which help a local economy to grow.

Crudely, I understand GVA can be defined as the grand total of all revenues to a business, net of any subsidies and the cost of all inputs and raw materials that are directly attributable to that production. So someone who takes precision car parts from somewhere else and screws them together to make a car is not adding huge GVA because the cost of the parts will be a large proportion of the sale price of the car. In contrast, someone who takes in lumps of iron ore (cheap) and turns out MRI scanners for hospitals (expensive) would add a lot of GVA. Likewise someone who can charge high fees for sitting at a desk doing stuff that comes out of their head (eg a lawyer or a programmer) generates a lot of GVA because the raw material going into their work is cheap (coffee)

Thank you, JFDI. Thank you, Hugh and Meng. You created something truly special and changed the startup landscape in Singapore. Looking forward to seeing the onwards and forwards.

True entrepreneurs go into the jungle alone and come out with a following. That is what Hugh and Meng did and I congratulate them. They are real trails-blazers. Their influence in Singapore and SEA will be around for a long time. We are deeply grateful to them. We know that they will continue to have a massive influence on start-ups and developments in general in their new roles. In the VUCA world of today we need to be bold. Increasingly, we also need to understand what we are to be bold for. The purpose of progress is being confused. I am sure Hugh and Meng are going to help straighten it out.

You both have our very best wishes.

John

It was a pleasure working with you, and I so look forward to your next adventures. What a difference you have made to so many from around the world!